Last week, Alberta’s energy minister released a statement regarding the Canadian Association of Petroleum Producers’ recent announcement of their projected energy sector capital investments for 2021.

In her announcement, Sonya Savage called the $27.3 billion projection “encouraging” and reported that it was an increase of nearly $3.4 billion over last year’s projections.

There are a few things from both Savage’s statement and the CAPP announcement you should know.

First, this projected investment is in upstream natural gas and oil capital spending. Upstream refers to businesses who focus on the early stages of production, such as exploration and extraction.

Second, although a $3.36 billion increase over what was actually spent on capital spending seems encouraging, last January, CAPP had projected a $37 billion investment. Capital investment in upstream projects was actually $13 billion lower in 2020 than they had originally projected.

It’s also lower than the estimated $35.1 billion invested in 2019.

And even with the extra $3.36 billion forecasted this year, $27.3 billion is still nearly $10 billion shy of last year’s estimate. Plus, it’s far lower than it was just 6 years ago, when they finished out 2014 at $81 billion in capital investments.

Third, the $27.3 billion projected investment quoted by Savage is for all of Canada. For Alberta specifically, CAPP projects upstream investment of $11.8 billion this year, up from $1.8 billion from 2020.

Fourth, both Savage’s statement and the CAPP announcement cite Alberta’s recent corporate tax rate slashing as one contributing factor to the increase in capital spending. However, remember that last year, when the corporate tax rate was still at 10%, the industry projected capital investment that was $10 billion more than this projection. As well, when capital investment was nearly 3 times as high as this year’s projection, the corporate tax rate was higher than the 8% rate that the UCP government implemented last summer.

Here, take a look at this chart, which shows oil production in Alberta between October 2010 and October 2020.

Overall, we see that oil production has trended upwards over the last decade. Whether corporate income tax was at 12% between 2015 and 2019, 10% before 2015, or 8–11% after 2019, it doesn’t seem to have significantly impacted production.

As well, capital expenditures in 2019 (half of which was after the UCP cut corporate taxes from 12% to 11%) were at $24.04 billion in the “mining, quarrying, & oil & gas extraction” sector, 16.1% lower than they were in 2018, under the NDP’s tax rates. (2020 numbers are not yet available, but will likely be lower because of the economic downturn.)

Here’s another chart. This shows the Alberta Activity Index over the last 10 years. AAX closely tracks economic activity using a weighted average of 9 monthly indicators, including rigs drilling and oil production.

There was a decline in the AAX after the NDP implemented their corporate tax increase, but the AAX had already been falling for 8 months before the tax increase took effect. Even so, it started to recover about a year later and by May 2018, the AAX had actually surpassed its 2014 levels. In fact, that month saw the AAX reach its highest level since 1981. All with a 12% corporate tax rate.

The AAX hit 283 in June 2019, the month before the UCP started cutting the corporate tax rate. The AAX has never been above that number in any month since then, even before the pandemic lockdown.

The corporate tax rate doesn’t seem to have any affect on the AAX, regardless of how low or high it is.

Plus, several researchers have found no direct correlation between corporate tax cuts and investment. For example, a 2011 study by Canadian economist Jim Stanford found no evidence in business investment and cash flow data over 50 years that indicated lower taxes stimulated investment. Actually, between the early 1980s and 2010, business fixed capital spending in Canada declined as a share of both GDP and corporate cash flow, despite the federal corporate tax rate being cut from 50% to eventually 29.5%.

Granted, the tax cut wasn’t the only contributing factor cited by CAPP (red tape reduction, for example, was another one, and that one makes sense), but there’s no evidence that a corporate tax cut will actually contribute to capital investment. And even if they’re convinced that it will, it’d be interesting to see how much exactly they think it’ll impact total investment.

Fifth, the minister’s announcement indicated that this investment will drive jobs and revenues. I mean, sure, of course it will increase revenue. Increasing your factors of production will increase your output, which increases your revenue. Whether you hire more workers, or build a second factory, or buy more machines, increasing production will typically increase revenue.

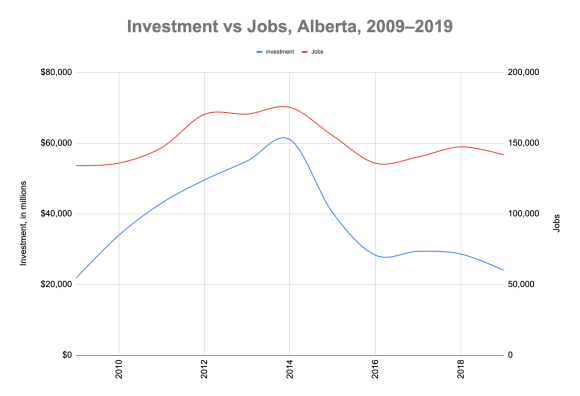

Jobs, on the other hand, well, that’s not as clear cut. This chart shows investment and jobs in oil and gas between 2009 and 2019.

There does seem to be a correlation between the number of jobs (red) and amount invested (blue): as investment increases, jobs increase, and as investment drops, so do jobs.

But the degree of change isn’t the same. For example, between 2009 and 2014, investment in oil and gas increased by 178.5%. Jobs, on the other hand, increased by only 30.7%.

Take a look at this table. It shows all the years over a decade when both investments and jobs in oil and gas increased and by how much, then how much investment was made for every new job that year.

| Change in investment | Change in jobs | Investment per job | |

|---|---|---|---|

| 2010 | $12.1 billion | 1,800 | $6.7 million |

| 2011 | $9.1 billion | 11,000 | $0.8 million |

| 2012 | $6.5 billion | 23,500 | $0.3 million |

| 2013 | $5.4 billion | 200 | $26.8 million |

| 2014 | $6. billion | 4,700 | $1.3 million |

| 2017 | $1.1 billion | 4,500 | $0.2 million |

There’s just no consistency. One year, there was 1 new job for every $243,000 in new investments; another year, it was 1 job for every additional $26.8 million invested.

So, just because capital investment may increase by 18% in Alberta this year doesn’t mean jobs will increase by 18%. Heck, it doesn’t even mean jobs will increase at all. In 2013, for example, oil and gas investment increased by $5.4 billion, or 10.8%, but that resulted in only an extra 200 jobs, or 0.1%. And CAPP expects only an increase of $1.8 billion in Alberta this year.

Finally, Savage claims that Alberta’s oil and gas reserves are important in meeting post-pandemic demand. Here’s the thing though.

Post-pandemic demand—at least in the short term—will be functionally the same as pre-pandemic demand. Increasing capital investments as a way to increase production will be irrelevant to demand, since the short-term post-pandemic demand won’t be significantly greater than demand previous to the pandemic. Especially considering that we were producing at record levels at the end of 2019, just before the pandemic and oil price crash hit.

But even in the long term, there’s something you should know about that demand Savage spoke of.

In 2019, Canada produced 4.7 million barrels of crude oil a day, 81% of which came from Alberta. It imported 0.8 million. Of the total 5.5 million barrel supply available, about 70% of it was exported out of the country. Only 1.7 million stayed in Canada for domestic refining.

Canada’s domestic demand for crude oil in 2019 was 1.7 million barrels a day. Alberta alone produced about 3.8 million barrels a day that year. It’ll be a while before Canada’s post-pandemic demand strains Alberta’s production capacity.

But what if Savage was including global demand, too?

Well, 98% all Canada’s crude exports in 2019 went to the United States, so pretty much all of it. And that accounted for nearly half of all US crude imports.

Except imports make up such a small amount of US oil supply. In fact, 94.9% of oil consumption in the US in 2019 was supplied by its own domestic production. And that percentage has been increasing for years, with the strong possibility it could reach 100% this year or next, if it hadn’t already passed it last year (2020 numbers haven’t been released yet).

In other words, Canada exported enough oil in 2019 to supply about 2.25% of US oil consumption that year (once you factor in net imports). Canada sends over 2/3 of its product to a country that doesn’t even need it.

Why is Canada producing 3 times as much oil as it needs? Why is it shipping most of it to a market that doesn’t need it?

Well, the answer lies in Savage’s statement, as I alluded to before:

Today’s news mirrors the considerable optimism we have recently seen in Alberta through increased drilling, rig counts and upstream development – all of which will drive jobs, revenues and further investment in our province

Revenues.

That right there is the reason.

Remember that graph I showed earlier regarding Alberta oil production?

Alberta didn’t go from producing 10 million m3 (62.9 million barrels) of oil a month in 2010 to 18.4 million m3 (115.8 million barrels) a month in 2019 because domestic demand for it doubled. Heck, 2010 production levels were already higher than 2019’s domestic consumption levels.

It wasn’t US demand driving it either. US’s domestic production has been increasing for roughly the last 15 years, and its oil imports have decreased 33.6% during the same period.

Alberta oil production has been steadily increasing for years. But demand hasn’t. It’s not demand driving the constant increase in production for at least the last decade. It’s revenue.

This increase in capital investment isn’t about meeting market demand. It’s about generating revenue. Because the more oil produced, the more revenue generated. And the more revenue generated, the higher the profits.

We don’t export 70% of the oil we produce because the world needs that oil. We export it because we’re producing too much.

Canada’s demand for oil increased only 11.9% between 2009 and 2019. The United States has decreased all imports by 33.6% (they take about 98% of Canada’s exports) during the same period. Yet oil production in Alberta has increased about 85%.

That’s why it’s desperate to build pipelines.

Jason Kenney and Rachel Notley weren’t demanding pipelines because the world is demanding our oil. They were demanding pipelines because Alberta is producing more oil than it knows what to do with.

Canada doesn’t need it. The US doesn’t need it. But Alberta keeps ripping it out of the ground. Because companies don’t invest $24 billion into capital spending just to let all that oil sit in the ground. They invest it to make money. But ripping it out of the ground doesn’t make money either. Someone has to buy it.

And that’s why Alberta wants another pipeline to the US. Because the US will buy it. It doesn’t need it, but the US is happy to take it, refine it, send 37% of it back to us, then export the rest. After all, it exports more than twice as much oil as Canada does, and that number keeps rising every year.

It’s why Alberta wants to expand capacity of a pipeline to Vancouver. Because it thinks Asia will buy its oil.

However, in 2019, China imported over 500 million tons of oil in 2019. Only 0.4% of it came from Canada. Put another way: if you spread out all of China’s oil imports over a year, Canada’s contributions cover about a day and a half.

The US shipped 3 times as much as we did, and even they supplied only 1.3% of the imports. Even China’s largest importing partner, Saudi Arabia, shipped just 16.4%. 23 other countries shipped more oil to China than we did. Equatorial Guinea, a Central African country with a population smaller than Calgary’s, shipped more oil to China in 2019 than we did.

Same goes for India. 222 million tonnes of oil imported in 2019 from 24 countries. Canada was last place. Again. Our imports amounted to 0.4%.

If the world’s two largest countries don’t need our oil, who’s going to take it? Are China and India going to take it just to be nice? They certainly don’t need it.

But what other choice does Alberta have? You can’t extract that much oil out of the ground and let it just sit there. We don’t have the ability to just store it all. And companies want to make money off it. And the only way to do both of those things is to send it out of the country and hope for the best.

Alberta’s oil industry is a prime example of why the mainstream economic theory of supply and demand is a joke. Alberta companies produce first. Then they try to find the demand.

And the Alberta government keeps bending over backward to make it all happen. After all, what politician wants to go down in history known as the premier in charge when all the oil companies left Alberta?

10 replies on “Alberta’s energy minister is cheering on oil investment that’s 34% lower than it was in 2014”

Clearly neither Canada nor the US has a domestic need for more crude oil than Alberta is currently producing. But isn’t global demand for crude oil still increasing, which increased production from Alberta could help to satisfy (even if the US acts as a middleman for the most of it)?

“Despite the challenges posed by the COVID-19 pandemic, the Organisation for Petroleum Exporting Countries, OPEC, yesterday, projected a 6.56 percent growth in global crude oil demand to 95.89 million barrels per day in 2021, compared to 89.99 million barrels per day in 2020.”

Read more at: https://www.vanguardngr.com/2020/12/opec-projects-7-rise-in-global-crude-oil-demand/

Right, but as my points regarding China and India indicate, that demand is already being met by much larger players. Canada’s supply on the global market seems to be insignificant. Unless you count the oil that the US gets from us, refines, then exports. Even then, the US doesn’t seem to be a large player either, although larger than us.

In the link below, Canada is listed 5th for most oil exports. However, as I indicated above, 98% of our exports go to the United States. If you ignore that, then we place 44th, below Trinidad and Tobago.

https://en.wikipedia.org/wiki/List_of_countries_by_oil_exports

If you account for imports, Canada is 16th for net exports, but again, nearly all of that goes to the US.

https://en.wikipedia.org/wiki/List_of_countries_by_net_oil_exports

Both the US and Saudi Arabia produce 3 times as much oil as we do. Russia produces 2.5 times. Iraq, Iran, and China also produce more than we do, but just barely.

As well, the numbers in the article you linked to are below 2019 consumption levels, so even if we do meet those targets, the world wouldn’t have to increase production capacity to meet them, let alone Canada, or even Alberta.

https://www.eia.gov/outlooks/steo/report/global_oil.php

You make good points, but could it be that China and India don’t import much of our oil because we have no way to get more to them? Could we maybe be in the top 5 exporters to those countries if we could displace some of these other suppliers?

That’s a possibility, but we’d have to export way more than we do now. Brazil, who exports the 5th highest amount to China, exported nearly 20 times as much oil to China in 2019 as Canada did. We’d have to either produce way more, or we’d have to ship less to the US. And then we’d have to convince these countries why they should buy from us instead of the 20 countries ahead of us.

If only post media didn’t have a monopoly on Canadian mainstream news outlets, wasn’t a far right wing owned conglomerate, and cared one flying fuck about fair and balanced reporting, they might offer you a few Canadian pesos for this fine piece of work Kim.

Thank you.

Thanks, Ken.

The very essence of the corpirate PetroRacket is to “scam”, extract, exploit, externalize propagandize, induce interest-conflicted influence-peddlers to peddle interest-conflicted influence… To do whatever it takes to maximize profit regardless of the collateral damage

That deficiency in this psychosociopathic eco-cidal cronyCorpiratist trickle-up Capitalist kleptocracy must be fixed.

The ultimate responsibility for conducting their public offices with impeccable integrity and honour which includes holding the public interest as primary and which includes not_being_scammed, lies with the holders of the public offices.

Unfortunately those offices are routinely infested with otherwise unemployable grifter-grafters who collude and conspire with corpirations, domestic and foreign, to undermine the public interest.

It was well-known, self-evident, obvious that the no-strings unconditional corpirate TaxCuts would produce zero ROI, an instant deficit which would be used as pretext for an austericist class-warfare while vandalizing, looting and privatizing the public. Drumflethinskin did it in Amerikkka the very year before Kennochio.

While these details are interesting from a financial-porn perspective, the deeper issue is the flagrant breach-of-trust and dereliction of duty-of-care by public office holders — in collusion with the PetroRacket.

How to excise that ?

[…] Or the change from having the provincial cabinet needing to approve any bitumen mining projects with a projected output of over 2,000 barrels a day to giving unilateral approving authority to the energy minister. Clearly, that benefits the mining companies, but at what cost? What guarantee do we have that the minister will do due diligence before approving such projects, especially when there’s pressure to mine more bitumen. […]

[…] Alberta’s oil and gas sector doesn’t compete globally. Nearly all their exports go to the United States. Of those that go to other countries, they make up […]

[…] that this pipeline capacity was already there. And the US doesn’t even need our oil, given that their own production is higher than their consumption. They just refine it and sell the finished product to other markets, including back to […]